Wouldn't it be cool to be part owner of a football club? Yes, it is actually possible!

If you are considering buying shares in Manchester United or another football club, you will find out what you need to think about in this article.

You will learn which factors are important to know about when it comes to the football industry, as well as which other football shares you can trade on the stock exchange.

Further in this article, you can read more about the various factors you should have control over if you want to invest in Manchester United shares, or other football shares.

Let's start by looking at which football stocks you can actually buy.

Which football clubs are listed on the stock exchange?

Several well-known football clubs are listed on stock exchanges around the world. Some examples include:

- Manchester United: One of the most successful and popular football clubs in the world, Manchester United is listed on the New York Stock Exchange (NYSE) under the ticker symbol "MANU".

- Juventus: "The Old Lady" is listed on Borsa Italiana, the Italian stock exchange, under the ticker symbol "JUVE". You can find it with the ticker symbol "JVTSF" on Nordnet.

- Ajax: This Dutch football club is listed on the Euronext Amsterdam stock exchange under the ticker symbol "AJAX".

- AS Roma: This Italian football club is listed on the Borsa Italiana under the ticker symbol "ASR".

- Borussia Dortmund: This German football club is listed on the Frankfurt Stock Exchange under the ticker symbol "BVB".

You can buy football stocks at Nordnet, which is the online broker I recommend you use if you want to invest in shares.

By investing in the shares of these listed football clubs, you can become a shareholder (owner) in a football club and potentially make money on your investment.

But it is important to carefully consider the risks and rewards of investing in football clubs.

Because...

…a football club is a company

You have probably heard the well-known statement that you must know what you are buying if you are going to invest in stocks.

If you are a football fan, you probably have a great deal of insight into what the owners of your favorite club do, which players run the kit sales, whether they invest in the training facility and how good the clubs are in general at recruiting players.

These are all factors that affect the club's earnings and growth, just as other companies depend on them too.

The other common feature is that investing in football clubs involves many of the same risks and rewards as if you had invested in any other type of company.

On the one hand, football clubs can be financially successful and give you as an investor the opportunity to earn a good return on your investment.

Strong financial management, a strong support base, good player recruitment, combined with sporting success on the pitch are key points to whether a football club makes good money or not.

Read also: shares for beginners: a great guide to investing in shares and fund

Specific factors

Some specific factors that increase the income streams of a football club can be ticket income, season tickets, kit sales, player sales, prize money from, for example, national cups or the champions league, as well as other merchandise (coffee cups, key rings, scarves and so on).

On the other hand, investing in football clubs can also be risky. Clubs' financial performance can be affected by a number of factors, such as the club's sporting performance, market conditions (such as the pandemic, such as first-to-empty seats and zero ticket revenue) and the club's financial management.

In addition, the football industry is exposed to unique risks, such as the possibility of injury to key players and changes in the sport's rules and regulations.

Although football clubs such as Manchester United can be an exciting and potentially profitable opportunity, it is important to consider such important factors before making a purchase.

Let's go more in depth on 5 important factors:

1. The club's financial health

Just like in any company, it is important to evaluate the financial stability of the club before investing.

It involves checking the financial statement and seeing how much income, expenses, equity and debt the club has. You can easily check this by creating a free user at Simply Wall St .

Let's use Manchester United as an example here. You can click on the image below, and you will be able to see the entire analysis yourself as well.

Look at the clubs revenue streams, such as ticket revenue, merchandise and sponsorship deals. It is also important to consider the clubs' expenses, including player salaries, facility costs and other operating expenses.

By looking at the club's accounts and performance over time, you do a quantitative survey and can gain an understanding of the club's key figures.

We see by quickly checking Man United's income, debt, dividends and future prospects that the club has some issues on the surface.

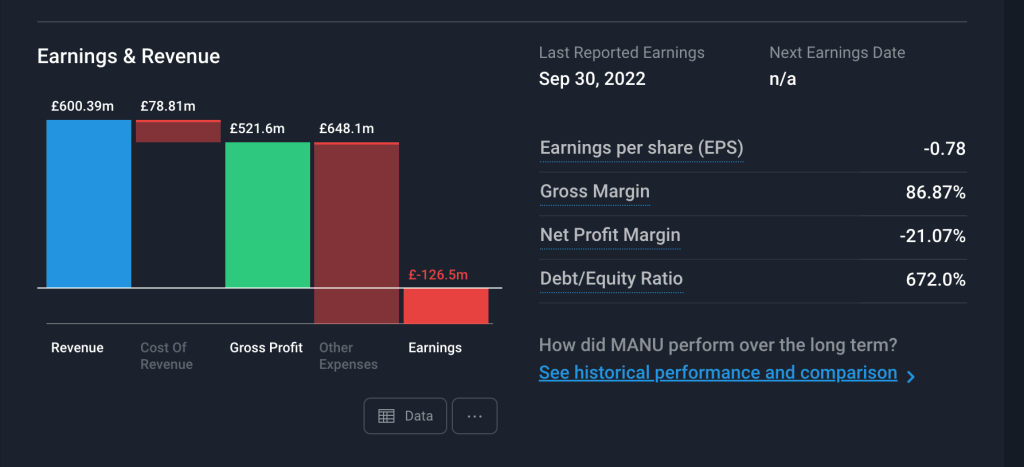

Man UTD has a lot of debt, as you can see below:

And not only that…

They also had negative earnings the previous year:

This tells us that the operation is not as efficient as it should have been, even though the club earns around 600 million annually.

2. Success on the pitch

Let's move away from Simply Wall St and on to a factor you can't see in black and white in a financial statement. We still use Man Utd as an example:

There has been a turmoil revolving Manchester United ever since Sir Alex left the manager's chair. The Glazer family who own the majority of the club but do not fix up the club's facilities, a returning legend who had a sudden end to the club and now plays in Saudi Arabia, frequent manager changes and so on.

This is the qualitative part of the analysis, which is also important to consider when considering whether to buy a football stock.

The club makes good money, but the actual management of the club seems to be unstable. The owners do not reinvest heavily in the club, but rather take the dividends for themselves.

In addition, there have been frequent replacements of many key personnel in the club in recent years, which can testify that they do not quite have a clear strategy for the future.

These are danger signals for you as an investor, and it is important to examine this in more detail before investing.

You can read more about stock investment for beginners in this article.

3. Potential of future growth

Although the club's past performance can be a useful indicator, it is also important to consider the club's opportunities for growth in the future.

Look at factors such as:

- The clubs' supporter base, both locally and globally

- Sponsorships

- The clubs' opportunity for sporting success, including the ability to attract and retain top talent

The success of a football club on the pitch can therefore have a big impact on the economy, so consider how the opportunities for Manchester United are here.

Consider the club's current position in the league, as well as its sporting CV in recent years. A club with a strong sporting CV can be more attractive to sponsors and generate higher income from ticket revenue and merchandise.

There is little doubt that Manchester United are strong here. A number of Premier League and Champions League trophies, as well as the fact that they have produced football legends such as Beckham, Giggs, Scholes, etc., have given Man Utd a huge fan base which is attractive to reach out to many sponsors.

4. Market conditions

Football clubs can control a lot, but not everything to achieve success. And although as an investor you should primarily only concentrate on what the club itself actually does, it is also important to keep an eye on the macro picture when you buy football shares.

Look at factors such as the state of the economy worldwide and how this affects football clubs.

This can help you understand the potential risks and rewards of your investment.

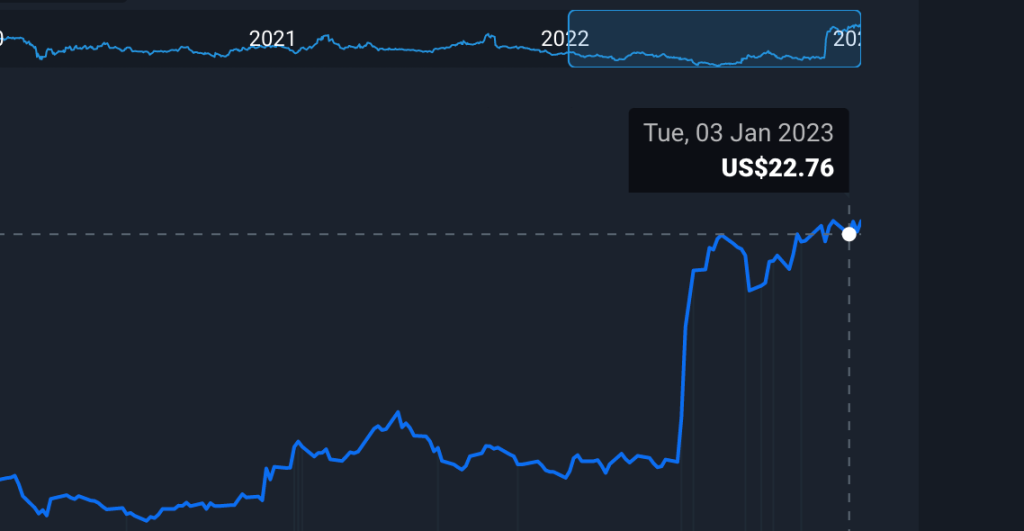

In the case of football clubs, market conditions are particularly evident. Just look at what happened to the share price of Man Utd in the picture above, after rumors of an acquisition by Apple arose.

5. Diversification

And finally: as with any investment you make, it is important to diversify your portfolio dn to spread the risk.

Consider investing in several football stocks instead of putting all your money in one club. Or even better: invest in a completely different sector, so that all your money is not in the football industry.

This can help you protect your investment in the event that a club experiences financial problems or underperforms on the pitch.

By carefully considering the factors in this article, you can make an informed choice when it comes to buying football stocks.

As with any investment, it is important to do thorough research and be prepared for both potential gains and losses.

Here you can buy shares in Manchester United

Disclaimer

This article is NOT a recommendation to buy the Manchester United share or any other football shares, but only content intended as information about football shares as an investment. Always do your own research before trading stocks.