Companies in the solar industry manufacture and install solar panels and other products that convert energy from the sun into electricity. In this article you can read about some of the companies in the sector.

With the high electricity prices, and an assumed increase in electricity prices in the coming years, solar cells will become a more and more important way of producing energy in the future.

The growth prospects in this market are potentially great, and the sector may therefore be worth taking a closer look at. In the United States there is talk of investments in 1.2 trillion class towards 2050. Globally, the opportunities are even greater.

More and more companies are focusing on solar cells, and want to take part in the sector's growth. There have been many players on the scene, but not all of them are necessarily good investments if we think about shareholder friendliness.

Invest like the pros with FinChat.io

For you who are serious about stock analysis. Get access to all important key figures in a company's accounts and KPIs. You get a 30% discount via me.

In this article I have tried to find solar cell companies that I believe are interesting for equity investors.

I have tried to put together a list of both the slightly larger, but also some smaller solar cell shares measured in market value.

IMPORTANT: None of the stocks mentioned in this article are buying recommendations, and there are other companies in the sector that may be even more interesting. But it may be worth taking a closer look at the companies, and see if any of them are interesting for your investment strategy. Remember to do thorough research before investing your money!

3 solar cell stocks you can take a closer look at in 2024:

- Brookfield Renewable

- First Solar

- SolarEdge Technologies

The images you see in this article are taken from the wonderful analysis program Simply Wall St. I recommend that you create a free user there and try it yourself!

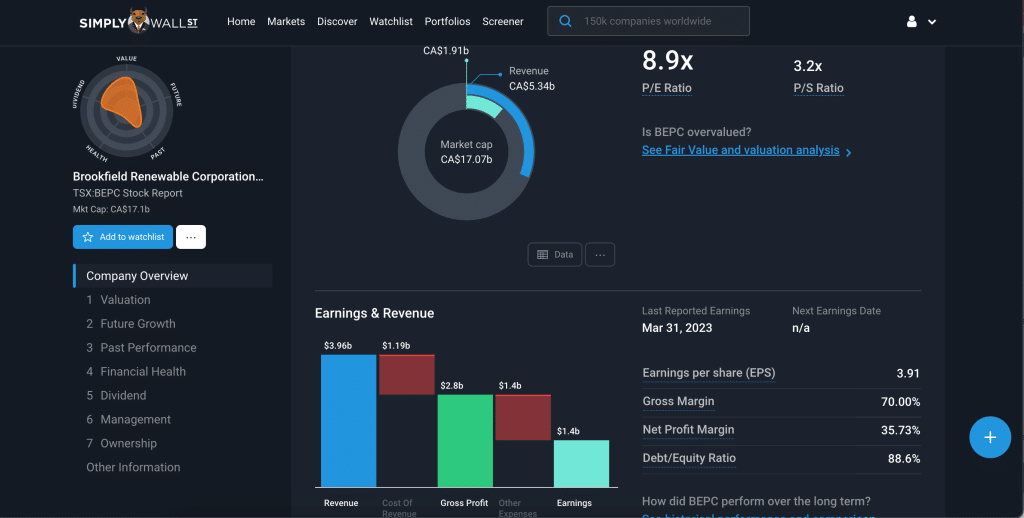

1. Brookfield Renewable

At the top of my list you will find Brookfield Renewable, a yieldco created by Brookfield Asset Management, which is a leading manager in Canada. The company produces renewable energy which is further sold under long-term power purchase agreements.

Brookfield's business model provides a stable cash flow to pay attractive dividends.

A yieldco is a financial structure that generates cash flow and pays dividends using long-term contracts for the production and sale of renewable energy. It is attractive to investors who want stable dividend income and long-term growth in the renewable energy sector.

The company has a broad and varied portfolio within renewable energy. They are a global leader in hydropower plants. They supplement these facilities with rapidly growing onshore and offshore wind energy, large-scale and distributed generation (such as roof-mounted) solar energy and energy storage platforms.

Brookfield Renewable believes that solar energy can make up the majority of production capacity within the next ten years. And it's not because they don't see a bright future for wind or hydropower, but simply because they see greater opportunities in solar energy.

Falling costs make solar development projects increasingly profitable.

Brookfield has made several acquisitions in recent years to increase its expertise in solar energy. In 2022, they acquired Urban Grid, a leading developer of large-scale solar and energy storage projects in the United States. The acquisition tripled their US renewable energy development pipeline.

Brookfield's solar development pipeline is driving increasing cash flow per share at an annual growth rate of 6% to 11% through 2026. In addition, they see up to 9% of additional growth potential per year from future acquisitions, which should support the company's plan to increase its high dividend from 5% to 9%.

The growth in dividends I believe makes it one of the best dividend stocks in the renewable energy sector. At the same time, the combination of growth and income will enable Brookfield Renewable to generate an attractive total return in the coming years.

Get started with investing at Nordnet

I recommend Nordnet because of their large selection of shares and funds, low fees, good learning resources + free access to the share forum Shareville (ad).

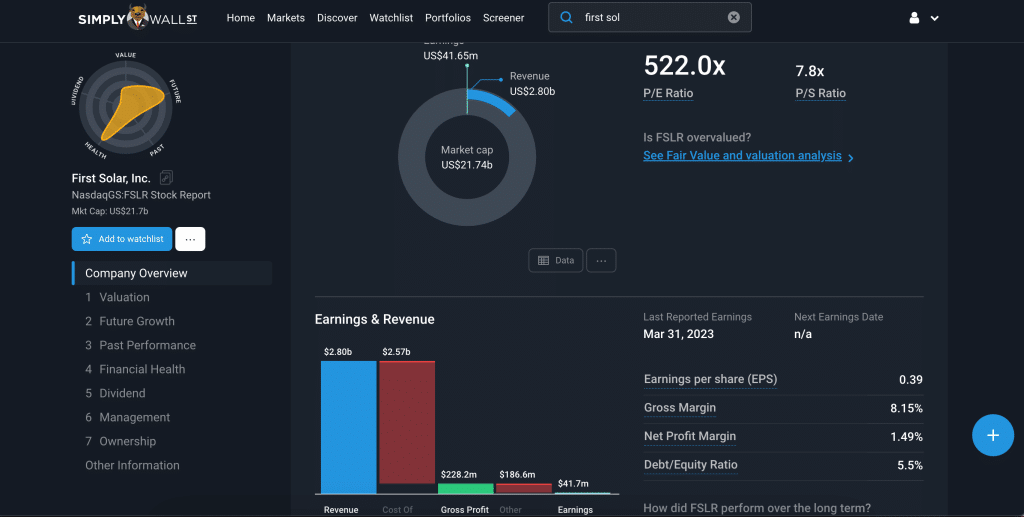

2. First Solar

First Solar is a global leader in the development of solar energy solutions. They develop, manufacture and sell advanced solar modules.

What sets First Solar apart from other solar cell manufacturers is their focus on manufacturing an advanced thin film module. In less ideal conditions such as low light and hot weather, their panels perform better than competing silicon modules.

The modules are also larger in size, which helps reduce the cost per watt. These factors make them ideal for large-scale solar projects.

First Solar also stands out from its competitors in the solar sector by having one of the strongest balance sheets. They have more cash than debt, which gives them financial flexibility to continue their strategy of developing and building thin-film solar modules for large-scale customers, and not least funds to expand production capacity.

First Solar is in a strong position to flourish as the solar industry continues to grow, and has many growth opportunities ahead. The company has sold out its production capacity until 2024 and has signed sales contracts until 2026.

They are investing heavily to expand their solar production capacity and take advantage of the sector's growth. These investments are expected to enable rapid growth in First Solar's revenues and profits in the coming years.

At the time of writing, First Solar has a hefty PE of over 500. In other words, the growth potential is expected to be extreme, but there may be better times to buy this than right now. So, add it to your wish list and follow it at Nordnet.

Get started with investing at Nordnet

I recommend Nordnet because of their large selection of shares and funds, low fees, good learning resources + free access to the share forum Shareville (ad).

3. SolarEdge Technologies

Last on this list is SolarEdge Technologies. This company manufactures power optimizers and inverters used to convert solar energy into electricity.

The company's components have improved the way solar panels convert direct current (DC) produced by the sun into alternating current (AC) used in the power grid.

A system using power optimizers made by SolarEdges will cost less than a system using a microinverter from, say, Enphase Energy, with minimal loss of power.

SolarEdge's focus on manufacturing cost-effective power optimizers has enabled them to wrest market share from competitors as solar project developers focus on cost.

The company has also invested money in the acquisition and development of new products in energy storage, energy management and smart modules to increase the average revenue per installation.

SolarEdge combines its leading market position with a solid cash-rich balance sheet. It gives them the financial flexibility to invest in expanding their production capacity and technological superiority over their competitors.

The strong balance has also given SolarEdge the opportunity to expand into other segments within smart energy. The company has invested in and acquired companies in storage, electric vehicle (EV) charging, batteries, backup power systems (UPS), EV power transmissions and grid services.

These initiatives could help accelerate their growth in the coming years and have positioned SolarEdge to succeed in the rapidly growing clean energy sector.

Get started with investing at Nordnet

I recommend Nordnet because of their large selection of shares and funds, low fees, good learning resources + free access to the share forum Shareville (ad).

Disclaimer

I may have ownership interests in one or more of the companies mentioned in this article. My articles should in no way be interpreted as buying or selling recommendations, but rather give the reader greater insight and knowledge about saving and investing. All use of information on this website - for example decision-making basis for the investment - is at your own risk.